We’re two weeks into 2023 and our portfolio is on fire thanks to some hot tech sector options trades!

Despite some choppy price action, markets held a bullish trend for the past five days and the first full trading week of the year…

In turn, that’s helped lead the beaten-down tech names on an incredible run with the Nasdaq gaining over 6%!

I’ve shouted from the rooftops about this explosive potential to anyone who would listen for the past two weeks…

I also had our New Money Crew strategies in position to jump on the opportunity to collect more outsized gains!

Wiretap Alerts Keep Streak Rolling With Hot Tech Sector Options Trades

For the second week in a row, Wiretap Alerts earned New Money Crew’s “trade of the week” honors!

This week’s big trade comes to us courtesy of Marvell Technologies Inc. (Nasdaq: MRVL)…

If that name sounds familiar, it should — I featured the hot tech sector options trades in last Friday’s special Blitz Daily.

Wondering what those little arrows mean and how they can help improve your trading? Get the details here!

That strong flow in chipmakers panned out Monday when analysts Wells Fargo released their outlook on the semiconductor sector…

The news helped boost Marvell stock by as much as 5.3% while Wiretap Alerts recorded a hefty 42%* gain on weekly options, blowing away our 11.7% average return — including all winners and losers since the start of the strategy on Sept. 24, 2021.

On top of Marvell, Wiretap Alerts completed the trio of winning trades with gains on Intel Corp. (Nasdaq: INTC) and GSK PLC (NYSE: GSK), giving us 13 winners in our last 15 trades and stretching the win rate to 73.2% with an average holding period of three days — you have to love it!

And with markets closed Monday for Martin Luther King Jr. Day… our weekend trade opportunities get an extra day to “cook”!

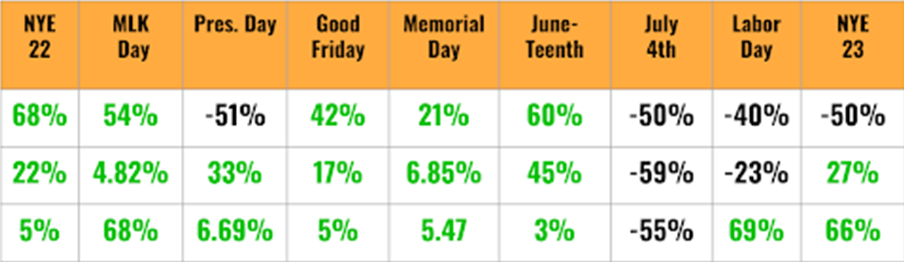

Last year, we had a 75% accuracy rate over EVERY long holiday weekend of the year…

And I’m beyond excited to see what next week brings! Find out all about it here.

Tune Into CTO and Crush Tech Earnings

Now don’t get me wrong, our New Money Crew strategies have killed it despite an extremely choppy market that’s been hyper-focused on inflation and the Federal Reserve’s response…

But now earnings season is right on our doorstep, meaning the market is about to give individual stocks a reason to spit out supercharged directional moves independent of the broader market!

I love earnings season because we won’t need Wall Street to make its mind up about everything all at once for a company to catch a bid… And now we have a laundry list of major market catalysts flooding the tape…

Of course, if you’ve been following me for a bit, you know I’m not a fan of big, boring bank earnings. They’re already priced to perfection most of the time, so it’s tough to get a move that beats market makers’ expectations…

But we can find those kinds of outsized moves in names that aren’t getting any love. And as we discussed in my 2023 outlook, good luck finding another sector as beaten-down and unloved as tech.

We have a full slate of the biggest software and technology names getting ready to report in the next few days, and at the top of my list is none other than our old friend Netflix Inc. (Nasdaq: NFLX)…

That’s just one of the names I’ll be looking at with Joy of the Trade’s Jeff Zananiri in our next edition of Crush the Open at 9 a.m. ET on Tuesday after a well-deserved long weekend!

In the meantime, you can check out our most recent video and hear me call out the tech names ahead of this week’s rally.

*Stated results are atypical for given period. Past performance is not indicative of any future results. Trade at your own risk.