>>>FRIDAY PREP CLASS: We’ll the share the strategy and tool we’re using to generate income each and every Friday, talk about some trades and more — Stonkamania starts at 1:30 PM ET!<<<

You know what’s exhausting about trading? Always having to be right about direction.

Buy the dip, nail the breakout, catch the momentum — it’s a constant game of precision that wears you down. And honestly? Most traders lose because they’re always one bad call away from giving back their gains.

But there’s a way to win even when the stock moves against your or doesn’t do exactly what it needs to for your trade to be profitable.

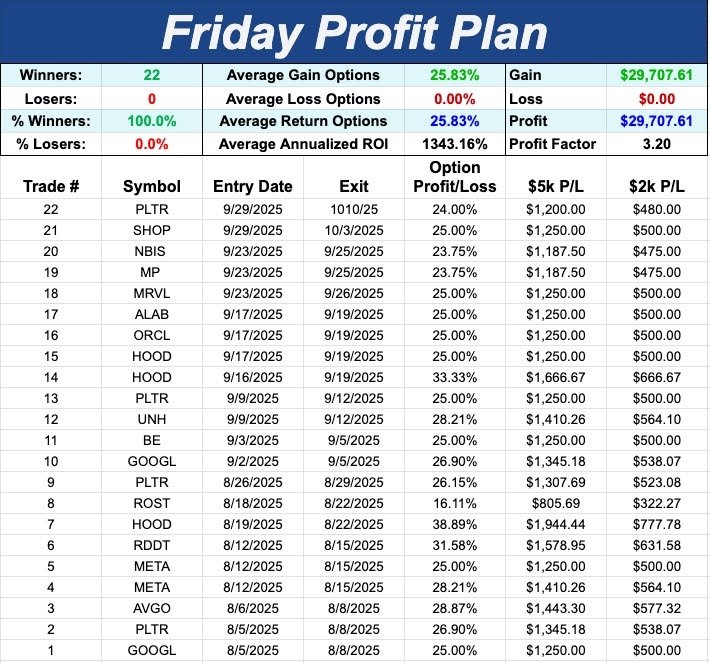

I’ve been using a strategy that’s posted 22 consecutive winners with an average return of $528 per trade. The secret isn’t some complex algorithm or insider edge — it’s a volatility-based metric called the “Market Maker Floor.”

Now, let me be clear. We haven’t lost a trade yet, but we will. It’s inevitable. There’s no such thing as a perfect strategy that wins every time.

If there was, I’d be a gajillionaire and you’d never hear from me again — hah! But this is exactly what we’ve done so far to hit on 22 straight!

What Makes the Market Maker Floor Different

Here’s the core concept: The Market Maker Floor is derived from the at-the-money straddle and represents the stock’s lowest expected price for the week. Think of it as the ultimate support line.

And here’s the kicker — stocks only fall below this floor about 15% of the time. That means we’re working with around an 85%** probability advantage right out of the gate.

Unlike traditional directional trading where you need the stock to rally or fall, this strategy only requires one thing: the stock must stay above the floor.

That’s it.

The stock can trend higher, move sideways, even drop 3-5% — as long as it doesn’t completely melt down below that floor level, you collect profits.

Why Market Makers Protect the Floor

Here’s what makes this strategy so powerful: Market makers have a vested interest in keeping stocks above the floor because they hold massive positions. We’re talking thousands, if not hundreds of thousands of shares to keep the stock liquid.

If the stock falls below the floor, they risk substantial losses on their books. So they’ll often set buy orders around the floor to prop up the stock.

Look, as I said, nothing in trading is 100% guaranteed. Stocks can fall below the floor, typically when something major happens like an earnings miss.

But that 15% scenario is fairly rare, and we’re playing the 85% probability side.

The way I’m playing this is to skip the Monday volatility, set up the trade on Tuesday (so the average hold time is three to four days), and let it expire and close automatically on Friday — no day trading stress, no constant monitoring.

Just a clear, high-probability setup that doesn’t require us to nail the exact direction.

This is what I mean when I talk about working smarter, not harder. Stop trying to be perfect. Start using probability, tools and market structure to your advantage.

Order Flow:

This is for informational and educational purposes only. These are not official alerts issued by Lance, but rather some interesting orders picked by the team at Lance Ippolito Trading.

When you look at these plays, always take the market maker move into consideration.

You can be right on the direction but still lose money if the stock doesn’t move enough. That’s where the market maker move comes in clutch.

With puts, they’re often downside hedges in case a stock tanks, especially around earnings. The further out of the money they are, the more likely they are to be hedges.

Also be sure and check when the company’s earnings date is because many of the plays we post here are centered around earnings!

If a stock is really expensive, consider a spread to lower the cost.

And finally, always remember the golden rule when it comes to buying calls: Buy dips, sell rips — and don’t chase!

If a stock’s moved a ton already today, maybe wait for a pullback.

There is inherent risk in trading. Trade at your own risk.

![]()

Note: If no date is listed after the month, it’s the monthly expiration (third Friday).

The team at Lance Ippolito Trading

Lance doesn’t want the CCP spying on him, so you’ll never find him on TikTok. Same goes for other social media sites, which are filled with impersonators, scammers and crypto bros.

You can only find him on his personal YouTube Channel — smash that Subscribe button! https://www.youtube.com/@LanceIppolito

And in his private Telegram channel: https://t.me/+-gVwEIwGJhplMTgx

Important Note: No one from the team at Lance Ippolito Trading, New Money Crew or any of its associated brands will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. I Just Opened the Door for You to Join the $500 Challenge

My new trade is up to 22 wins with 0 losses…

And I’ve turned it into a challenge to target around 500 bucks per week (on a $2k stake)!

**We develop tools and strategies to the best of our ability, but no one can guarantee the future. There is always a risk of loss when trading. Past performance is not indicative of future results. Stated results are from live published alerts between 8/5/25 and 10/26/25. The win rate has been 100% on the options with an average return of 26% over a 3 Day hold time.