Markets ripped higher Thursday after the Federal Open Market Committee raised short-term interest rates by 25 basis points late Wednesday.

The news whipped tech bulls into a frenzy, with the Nasdaq adding another 3% gain Thursday on top of the prior session’s post-Fed 1.6% pop.

And the sudden explosion in volume has my scanners working overtime as traders get their bets in place for the incoming tidal wave of tech earnings!

On Thursday, with Amazon, Google parent Alphabet, Apple and others set to report after the bell, we saw more than 60 different trades burn up the tape as trading remains red HOT!

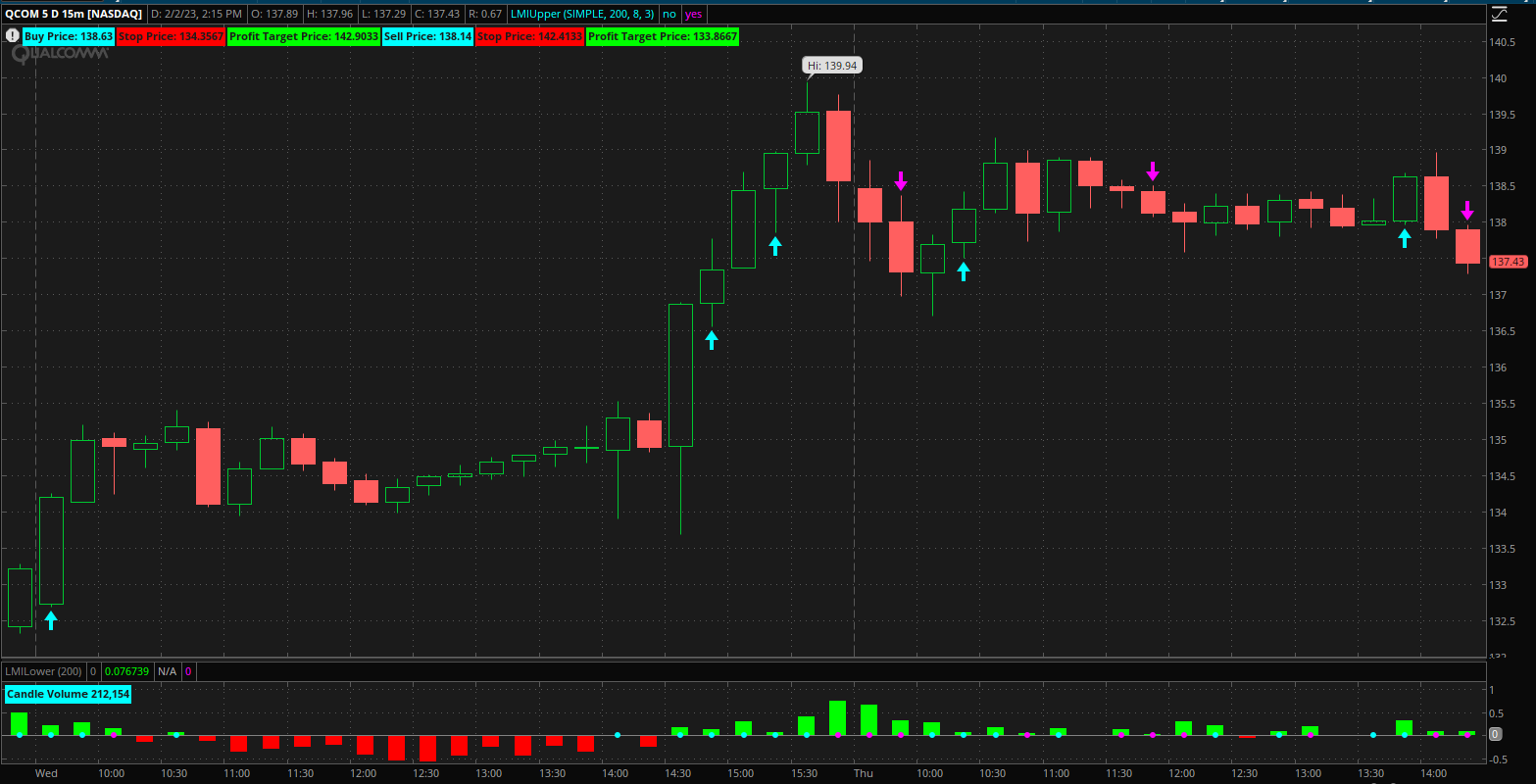

Among the earnings names hitting Thursday’s screens is top mobile chipmaker Qualcomm…

Wondering what those little arrows mean and how they can help improve your trading? Get the details here!

With shares of the semiconductor giant edging lower, the scanners spotted a big-money call buyer scooping up about 500 contracts of the Feb. 17 expiration, $138 strike calls for around $250,000 in premium!

This is one of the best times in the market to be following institutional order flow…

But you don’t have to take my word for it — see for yourself!

-

- Qualcomm Inc. (Nasdaq: QCOM): Feb. 17, $138 CALL.

- Cardinal Health Inc. (NYSE: CAH): Feb. 10, $77 PUT.

- Pinterest Inc. (NYSE: PINS): Aug. 16, $32 CALL.

- FirstEnergy Corp.. (NYSE: FE): Feb. 17, $42 PUT.

- Block Inc. (NYSE: SQ): Feb. 17, $87.50 CALL

- Amazon.com Inc. (Nasdaq: AMZN): Feb. 10, $117 CALL.

- Alphabet Inc. (Nasdaq: GOOGL): Feb. 3, $104 PUT.

- Walt Disney Co. (NYSE: DIS): Feb. 17, 115 CALL.

- Netflix Inc.(Nasdaq: NFLX): Feb. 3, $375 CALL.

Check out my short video as I break down the day’s most unusual options order flow in no time flat!

P.S. THIS Can Potentially Help Boost Your Trading Efforts

The new year is filled with opportunities to potentially win big in the markets…

But it’s also packed with plenty of ways to potentially lose.

What you need is an edge on the markets.

Something that isn’t widely known…

And works whether 2023 proves to be a bull or bear market.

Joy of the Trade’s Jeff Zananiri recently sat down with market analyst Garrett Baldwin to discuss exactly this.

During the presentation, Jeff outlined a little-known daily market occurrence that regular investors can use to potentially help their trading efforts.

It’s not a risky earnings move… not an insider buy…

It’s actually a bit of a “dirty secret” around the money-managing industry.

And it could very well be the edge that makes a difference in your trading this year.

Blitz Daily With Lance Ippolitto

At Weekly Blitz Alerts, we follow the big fish and what they’re buying. And we do that with my proprietary Blitz Scanner, which alerts me to big, institutional order flow through the day. Then we get in on these plays and follow the “smart money.”

The Blitz Daily with Lance Ippolito is where I go over a few options trades that hit the Blitz Scanner each day, Monday through Thursday. I break down the trades with the sexiest order flow and tell you what could happen with those stocks by the next day’s opening bell.*

If you want in on these explosive options plays, be sure to sign up for Weekly Blitz Alerts! We send entry, profit targets and exits directly to you via text and email alerts.

In the meantime, you can check out my YouTube channel for more trading insights and tips. And as always, you can find me right here talking stocks and options trading on newmoneycrew.com!

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.